23+ mortgage tax deduction

Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Click the New Document option.

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

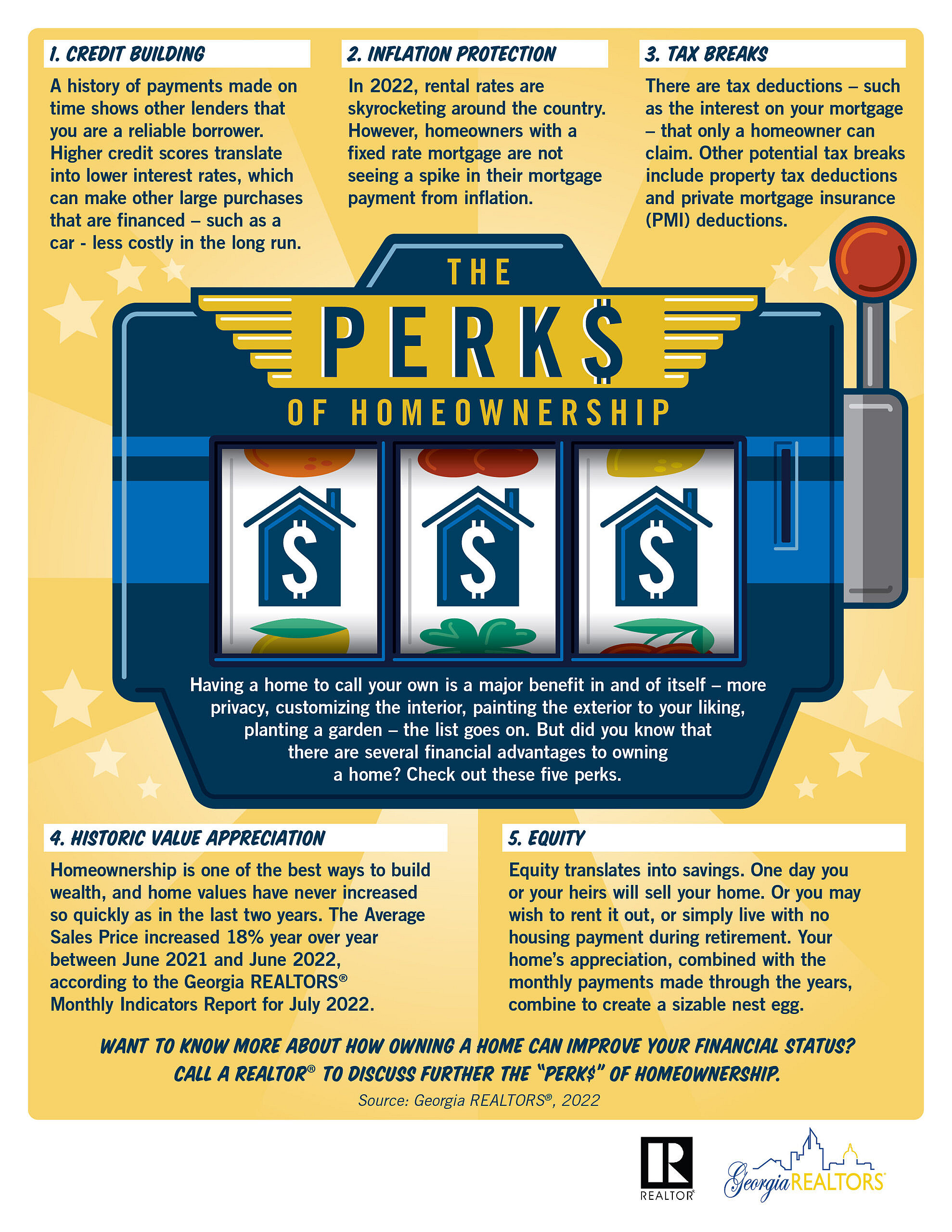

For now were interested in all the money-saving perks connected to your home and.

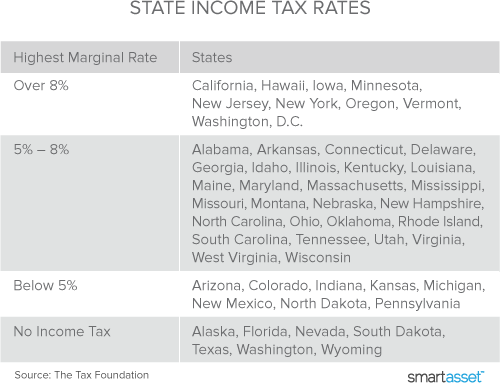

. Web The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your federal income. The bank provided Form 1098 which listed the 7280 in loan interest. Web And it goes without saying a licensed CPA can help you with all kinds of tax strategy.

Ad Get Help with Tax Prep From an Experienced Tax Pro at HR Block. If youre hoping to deduct the interest you paid on your mortgage. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

For tax years prior to 2018 your mortgage interest deduction is. Single or married filing separately 12550 Married filing jointly or qualifying widow er. Face-to-Face Tax Prep In-Person or Virtual.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Standard deduction rates are as follows.

Upload Your Tax Docs Beforehand. Web Legislation May Make MIP Tax Deduction Permanent. See If You Qualify Today.

Heres how it works. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. State and local taxes.

Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Web Here is the workaround. Web These costs are usually deductible in the year that you purchase the home.

Edit your 936 online. Web So because Im in the 24 tax bracket I should expect 24 x 46000 11040 on my tax return assuming my mortgage payments began on January 1st. Web For the 2022 tax year meaning the taxes youll file in 2023 the standard deduction amounts are.

Single taxpayers and married taxpayers who file separate returns. Web For 2022 theyll get the regular standard deduction of 25900 for a married couple filing jointly. Get an idea of your estimated payments or loan possibilities.

Web Most homeowners can deduct all of their mortgage interest. Web Also with all possible tax deductions your first priority is most likely to save money and earn tax advantages. Web Is mortgage interest tax deductible.

Add the Irs mortgage deduction for editing. Web The 2023 standard deduction for taxes filed in 2024 will increase to 13850 for single filers and those married filing separately 27700 for joint filers and 20800. Web For 2021 tax returns the government has raised the standard deduction to.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web For 2023 such taxpayers generally get an additional 1500 per married person up from 1400 for 2022 or 1850 per single person up from 1750. But if not you can deduct them pro rata over the repayment period.

Web The interest deduction is an essential and beneficial tax provision for individuals who own homes. For example if you. However higher limitations 1 million 500000 if married.

12950 for tax year 2022 Married taxpayers who. Web The IRS started accepting 2022 tax returns for individual filers on Jan. Please click on the attached link.

12950 for single and married filing separate taxpayers. Home Mortgage interest being limited. Web Here are Sallys itemized deductions for 2020.

Over 12M Americans Filed 100 Free With TurboTax Last Year. Try our mortgage calculator. The bipartisan Middle-Class Mortgage Insurance Premium Act was.

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. It allows taxpayers to lower their overall tax burden by. For this purpose do the groundwork.

They also both get an additional standard deduction amount of. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Mortgage Interest Deduction How It Calculate Tax Savings

Trading De Credito Bonds Exercicio Previo Pdf Pdf Standard Poor S Earnings Before Interest

What To Bring To A Tax Appointment Tax Checklists Forms You Must Have The Handy Tax Guy

Gutting The Mortgage Interest Deduction Tax Policy Center

Collette Mcdonald Collettemcdonal Twitter

Mortgage Interest Deduction Rules Limits For 2023

The Manual Of Ideas Large Cap Stocks How Cheap Are They By Beyondproxy Llc Issuu

Mortgage Interest Deduction Rules Limits For 2023

Moneysprite London

Mortgage Interest Deduction A 2022 Guide Credible

Mortgage Interest Tax Deduction What You Need To Know

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

23 Salary Certificate Formats Pdf Word

Mortgage Tax Deduction Calculator Homesite Mortgage

Mortgage Interest Tax Deduction Smartasset Com

How Much Do Apprentices Get Paid And Taxed In England Tax Banana

Mortgage Interest Deduction Rules Limits For 2023